Think twice before you buy that Chief or your parts from overseas

The article below will worry quite a few people, that have thought about importing a vehicle from overseas, that light in the tunnel is quickly coming to a end what with all the asbestos problems that Border Force are now applying, The other problems are if you say take a bike to a International Rally in USA or Europe the is a chance even know you exported it that it may not be able to come back here ever so it’s in limbo, plus the government may get your previously or currently registered vehicle in Aussie, fully inspected at your cost before allowing its return! Click on the links below

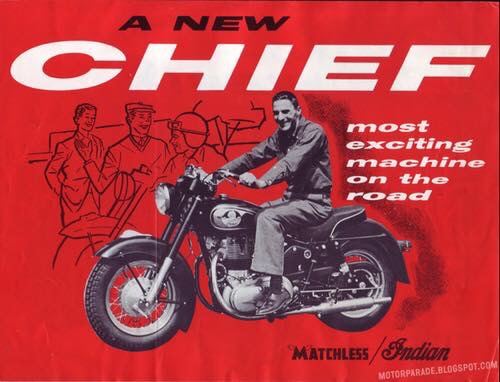

And today the Melbourne City Council is thinking of banning parking on footpaths, its more and more difficult to just be treated like bicycle riders. By the way that Matchless/Indian (pictured) is a Springfield Chief as it was sold by Indian Sales in the late fifties

Consequences for non-compliance for exporting into Australia

The compliance treatments we use vary according to the type of behaviour you exhibit. We group business behaviours into categories and apply an appropriate approach to each of those categories.

If you choose not to comply with the law, the Commissioner of Taxation can take actions including:

- registering you for GST

- imposing an additional 75% administrative penalty, which then becomes legally payable

- intercepting funds from Australia that are destined for you

- registering the debt in a court in your country

- requesting the taxation authority in your country to recover the debt on our behalf

Australia is the first jurisdiction to move to adopt a vendor-platform collection model and many jurisdictions are poised to follow suit (the European Union, Switzerland and New Zealand have all announced similar reforms).“

Taken from: